22+ Loan to value mortgage

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Or this value can be calculated by multiplying the propertys appraised value by 20 20 to get the total figure on a house deposit meaning.

1 Manufactured Home Loan Calculator How Much Can You Afford Manufactured Nationwide Home Loans 1 Manufactured Home Loan Lender In All 50 States

The second use for the loan to value is to determine a maximum mortgage amount.

. Save Time Money. Mortgage Refinance 90 Loan To Value Aug 2022. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

APR is the all-in cost of your loan. Mortgage Refinance 90 Loan To Value - If you are looking for a way to lower your expenses then we recommend our first-class service. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

The current average interest rate on a 30-year fixed-rate jumbo mortgage is 605 010 up from last week. For example if you have a mortgage of 150000 on. Refinance mortgage 100 out 90 to value.

Browse Information at NerdWallet. It describes the proportion of your home value that your mortgage takes up. Freddie Mac the federally chartered mortgage investor.

How To Calculate Your Loan To Value Ratio. Loan To Value Mortgage Refinance - If you are looking for a way to lower your expenses then we recommend our first-class service. Total Expert gives loan officers and marketers the digital tools they need data insights automation and compliance managementto deliver deeply personal interactions and.

The higher your down payment the lower. Ad Use Our Comparison Site Find Out Which Home Mortgage Loan Lender Suits You The Best. Refinance Mortgage 100 Loan Value - If you are looking for lower monthly payments then we can provide you with a plan that works for you.

To calculate loan-to-value you simply divide your loan balance by the appraised value of your. One of the ways your application is assessed is via your LTV which stands for loan-to-value ratio. Check your mortgage options.

How to work out the. Choose The Loan That Suits You. Just take the amount you need to borrow divide it by the value of the property and then multiply the result by 100 in order to get its percentage.

You would divide 180000 over 200000 to achieve your LTV of 90 for instance if a. Get All The Info You Need To Choose a Mortgage Loan. This would give you your combined loan balance and your combined loan-to-value formula would look like this.

This time last week it was 593. The APR on a 30-year fixed is 599. Current combined loan balance Current appraised value CLTV Example.

The loan-to-value LTV ratio is a measure comparing the amount of your mortgage with the appraised value of the property. Best mortgage refinance rates max to value refinance to. Calculating your loan-to-value is simple.

To accomplish this we multiply the loan to value by the value of the house. This means the loan amount 250000 8. Va to value ratio 80 to value ratio ltv low to value.

Loan to value mortgage rates typically range from 50 up to 95 so there are a variety of deals out there to suit most prospective homebuyers. Lender Mortgage Rates Have Been At Historic Lows. High Loan To Value Mortgage - If you are looking for suitable options then our comfortable terms are just what you are looking for.

Calculating LTV is fairly simple. Take Advantage And Lock In A Great Rate. 5 hours agoIt was 555 the week before and 287 a year ago.

The 30-year fixed average hasnt been this high since late June. You can calculate loan-to-value ratios by dividing the loan amount by the propertys appraised value. The 30-year jumbo mortgage rate had a 52-week low of.

All you do is take your loan amount and divide it by the purchase price or if youre. Its a percentage figure that reflects the proportion of your property that is mortgaged and the amount that is yours. Whether youre wondering if you have enough equity to qualify for the best rates or youre concerned that youre too far upside-down to refinance under the Home.

Get Instantly Matched With Your Ideal Home Mortgage Loan Lender. At an interest rate of 598 a 30-year fixed mortgage would cost 598. Ad Learn More About Mortgage Preapproval.

So it shows the value of your first mortgage in percentage terms against your property value.

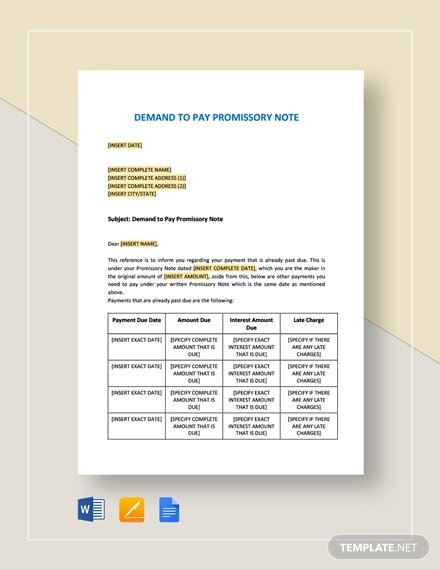

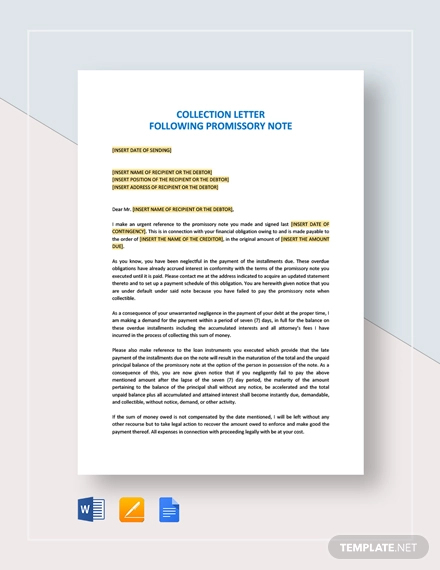

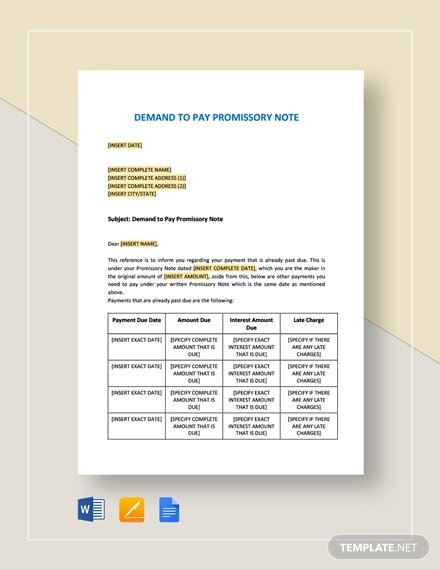

Promissory Note Examples 22 Pdf Word Apple Pages Examples

Credit Card Payoff Debt Tracker Progress Chart 100 Balloons Debt Free Goal Tracker Credit Card Debt Debt Payoff Debt Free Chart

Ex 99 1

Fun Gift Ideas For Clients 20 Or Less Desire To Done Virtual Assistant Client Gifts Clients

Ex 99 1

Ex 99 1

1

Scissors Pop By Gift Real Estate Gifts Client Gifts Pop Bys Real Estate

3

What Is Escrow New Venture Escrow

Promissory Note Examples 22 Pdf Word Apple Pages Examples

Free 22 Sample Self Assessment Forms In Pdf Ms Word Excel

Aesthetic Google Docs Notes Template

22 Printable Budget Worksheets Printable Budget Worksheet Budgeting Worksheets Free Budgeting Worksheets

2

Am I Doing This Right R Workreform

3